Can surplus banking liquidity lead to a steeper yield curve?

Mutual Fund

Introduction

FY25 witnessed significant fluctuations in banking and core liquidity, transitioning from neutral to deficit to surplus. This note delves into the dynamic management of banking and core liquidity by the Reserve Bank of India (RBI) using various tools and how this has in the past steepened the yield curve. As FY26 begins with surplus liquidity, the anticipated RBI dividend of at least INR 2.5 trillion is expected to elevate banking and core liquidity to INR 6 trillion. Furthermore, even though the RBI lowered rates by 50 bps, the net effective reduction is 100 bps as explained in the note. We foresee that maintaining sustained liquidity of 1% of NDTL or higher, coupled with slow credit growth, will lead to a rally at the short end of the fixed income curve resulting in a steeper yield curve.

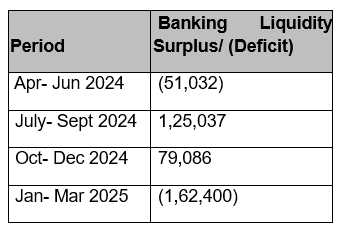

FY2024-25 was marked by significant volatility and fluctuations in banking and core liquidity. Initially, FY25 began with nearly neutral liquidity, but soon shifted into a deficit zone due to insufficient government spending. The announcement of the INR 2.1 trillion dividend by the RBI led to a surge in durable and banking liquidity during Q2 and Q3. However, this surplus liquidity was short-lived as FX interventions and currency leakage (amount held by public than in the bank) due to elections resulted in a liquidity deficit through most of Q4.

Average banking liquidity during each quarter last FY (Rs. Crs)

Source- RBI website, Internal Models

Shift in RBI's Liquidity framework

During Q2-Q3 of FY25, the economy faced several macroeconomic headwinds. These included FPI outflows, particularly in equity markets, and potential currency depreciation due to the strengthening of the dollar following the US elections. There was also a near-term rise in headline inflation in due to increasing food and vegetable prices.

Tight financial conditions, a depreciating currency, low government spending, weak external sector growth and tepid credit growth led to slowdown in high frequency indicators resulting in weaker growth in last year. The anticipated GDP for FY 2025 is 6.3%, compared to the estimated 7%.

Acknowledging weaker growth along with stable inflation and external sector outlook for FY26, the RBI prompted a change in its liquidity framework.

Since December 2024 - January 2025, we observed a shift in the RBI's liquidity stance from neutral/deficit to more than 1% of NDTL positive liquidity resulting in substantial liquidity injection over past few months. This 1% of NDTL equates to roughly INR 2.25 trillion of Durable/ Banking liquidity.

The RBI has injected more than INR 10 trillion of liquidity into system since December 2024 resulting in banking liquidity to swing from deficits of INR 3 trillion to a surplus of INR 1.25 trillion as of March 31, 2025

Movement in durable liquidity and summary of tools used by RBI

Source: RBI website, Bloomberg, Internal Models

Factors behind RBI's liquidity infusion

In addition to the macroeconomic reasons mentioned earlier particularly weak GDP, there are several other key factors that we believe prompted the RBI to inject more than INR 10 trillion of liquidity through various short and long term tools over past four months. These factors include:

- Ensuring the effective transmission of monetary policy cuts into deposit and lending rates to support the slowing economy

- Shifting the core/ durable liquidity deficit from a negative INR 1 trillion to a surplus liquidity of 1% of NDTL

- Neutralising the liquidity deficits that will arise in the banking system due to unwinding of short FX forwards, with maturities of 1-3 Months amounting to USD15-20 Bn.

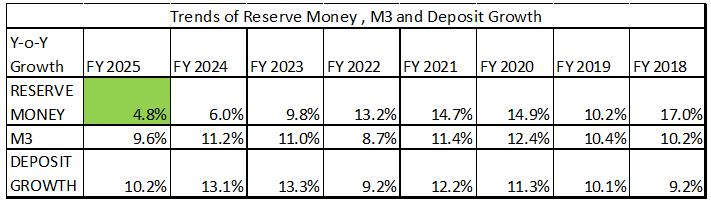

- Ensuring reserve money growth which had collapsed to below 5%* (as shown below in the table) year on year from an average of more than 10% leading to weak deposit and credit growth in the economy.

Slowing Reserve money (M0) growth impacted Deposit growth

Source: RBI website, Bloomberg, Internal Models

Is RBI done with its Liquidity injection? How much can we expect?

Based on our internal liquidity models, we believe that both banking and durable liquidity are currently comfortable, and financial conditions have significantly eased in past four months. Consequently, we do not foresee the need for further RBI intervention at this time. To set the context, in a scenario of tight liquidity, the effective rate, where banks are borrowing or lending funds, tends to gravitate towards the Marginal Standing Facility (MSF) rate while in periods of surplus liquidity, this rate moves to Standing Deposit Facility (SDF). Hence, while the rate cuts are 50 bps so far in this cycle, the effective rate has moved lower from MSF (6.75% in January 25) to SDF (5.75% currently) which is a total of 100 bps.

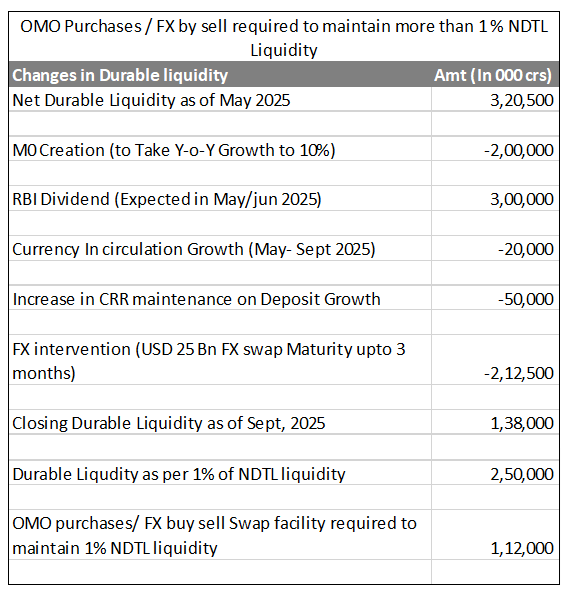

We anticipate that the RBI will declare and distribute another record dividend in the current financial year potentially exceeding INR 2.5 trillion. This substantial dividend would significantly boost banking and durable liquidity potentially raising it above INR 6 trillion in near term.

We believe that post the RBI dividend announcement, the pace of Open Market Operations (OMO's) purchases to fall significantly. We do not anticipate more than INR 1-1.5 trillion of OMO's until September 2025 unless there are substantial FX outflows, which could negatively impact government bonds, particularly long duration Govt bonds.

However, the need for some additional OMO's purchases may arise due to the large, short FX (USD) positions which could lead to a drag on core/ banking liquidity as they mature, necessitating Reserve money creation.

OMO purchases expectations till Sept 2025:

Source: RBI website, Bloomberg, Internal Models

Implications of Sustained Banking Liquidity Above 1% of NDTL

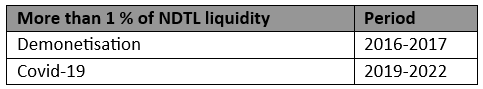

Our analysis of banking liquidity over the last 15 years, covering periods such as the Taper Tantrum (2013-15), Demonetization (2016-17), and Covid (2020-21), revealed that the RBI has never maintained sustained core/banking liquidity of more than 1% of NDTL except during the Covid and demonetization periods. This indicates a significant shift in the RBI's mandate which we believe will lead to a steepening of the yield curve, increased demand for short term bonds and a rally in bond markets in near term.

Instances in past 15 years of sustained more than 1% of NDTL Liquidity.

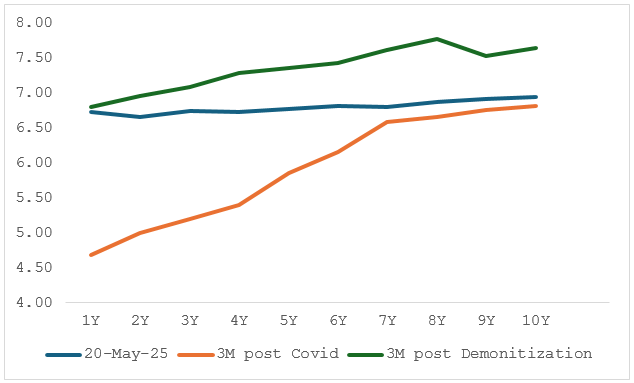

The chart below depicts the steep corporate bond curve during Covid 19, and Demonetization compared to flat curve currently.

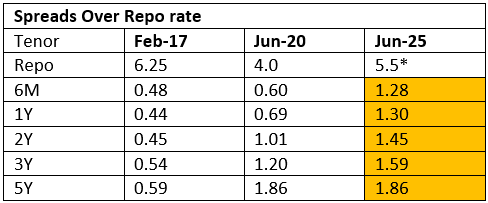

Analysing the past trends indicates that the yield curve tends to steepen over a period of 3- 6 months once sustained liquidity of more than 1% of NDTL is maintained in the Banking system. During this time, corporate bonds spreads over the Repo rate compress due to a strong demand for short term assets. The chart below depicts the attractive opportunity for spread compression in 1–5-year corporate bonds as seen in three months after the liquidity infusion by RBI during the periods of Demonetization and Covid.

*Assuming a 25 bps rate cut in June monetary policy and SDF Applicability due to surplus liquidity

Conclusion:

We anticipate that maintaining sustained liquidity of 1% of NDTL or higher coupled with slow credit growth will lead to a rally in short end of the fixed income curve and result in a steeper yield curve. Consequently, we expect 1–5-year corporate bonds to rally and outperform long bonds on a risk reward perspective.

Additionally, we foresee a limited rally in government bonds going forward, as we expect a shallow rate cut cycle and incremental OMO purchases to be limited to INR 1-1.5 trillion.

DISCLAIMER

Source & Date: Bloomberg, Axis MF Research, RBI. Date: 20 May 2025

Disclaimer This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s).

Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025

-

Axis MF Launches Axis Income Plus Arbitrage Passive FOF

Oct 28, 2025